Foreclosure Defense Tactics: New Laws to Save Your Home in 2024

Foreclosure Defense Tactics: Discover the new laws in 2024 that can save your home and protect your rights with our comprehensive guide.

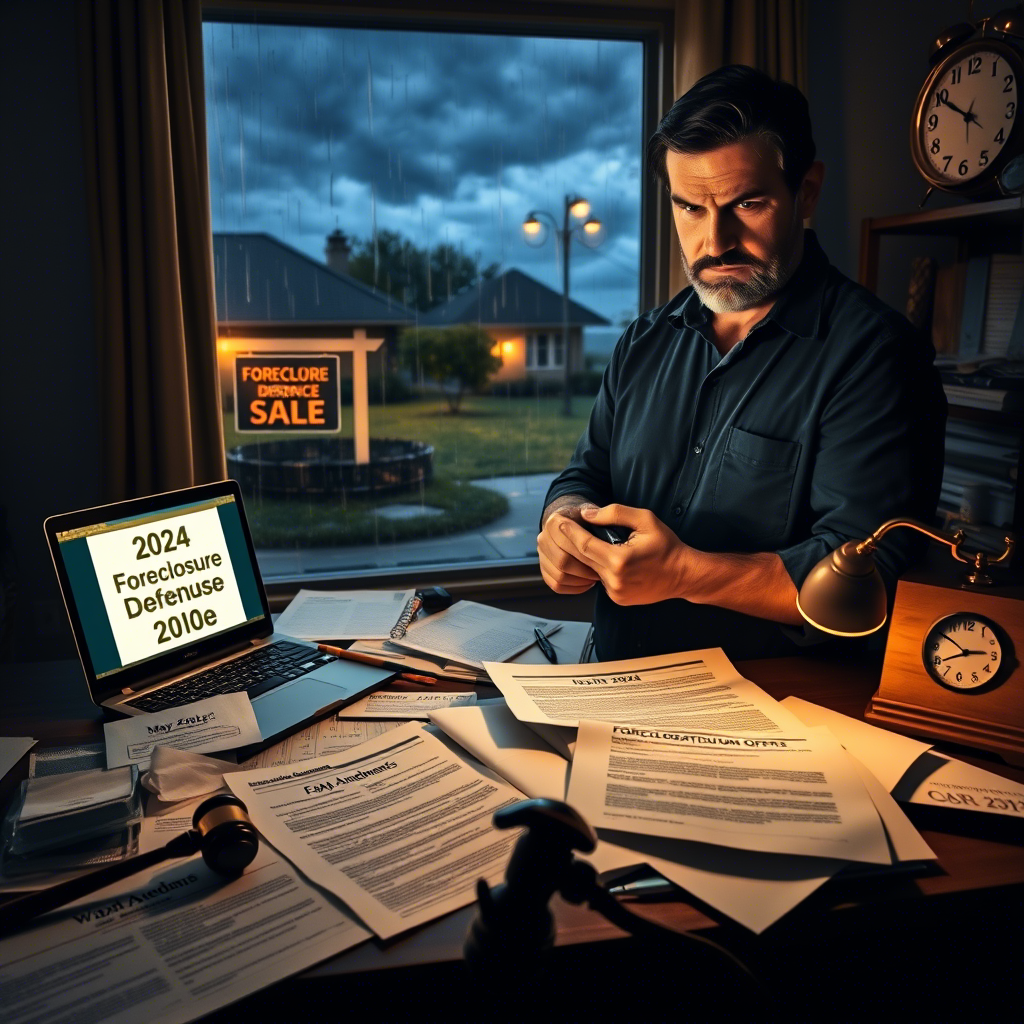

Facing foreclosure is a stressful and challenging ordeal. With new laws introduced in 2024, homeowners now have fresh avenues for defense against unjust loan practices and predatory lenders. This in-depth guide explores the latest foreclosure defense tactics, explains the new legal protections available, and provides actionable steps you can take to safeguard your home.

“Understanding the new legal landscape is crucial. These laws are designed to protect homeowners and ensure that every individual has a fighting chance to keep their home.”

– Housing Law Expert

In this article, we will cover:

- Understanding Foreclosure and the Impact on Homeowners

- New Foreclosure Defense Laws in 2024

- Effective Tactics to Fight Foreclosure

- Step-by-Step Action Plan for Homeowners

- Real-Life Case Studies and Success Stories

- Key Resources and Legal Assistance

- Expert Advice and Consumer Tips

Let’s delve into these topics and equip you with the knowledge to navigate foreclosure defense in today’s evolving legal environment.

🏠 Understanding Foreclosure and Its Impact

Foreclosure is a legal process in which a lender seeks to recover the balance of a loan from a borrower who has stopped making payments by forcing the sale of the asset used as collateral. This process can have devastating effects on families, communities, and local economies.

🔍 What Is Foreclosure?

Foreclosure occurs when a homeowner defaults on their mortgage payments, prompting the lender to take legal action. The process can vary by state, but generally includes the following steps:

- Notification: The homeowner is notified of the default.

- Pre-Foreclosure: A period during which the homeowner may still avoid foreclosure by catching up on payments.

- Auction: The property is sold at public auction.

- Post-Foreclosure: If the property is not sold at auction, it becomes a real estate owned (REO) asset for the lender.

📉 The Toll on Homeowners

Foreclosure can result in:

- Loss of Home Equity: Years of investment may vanish.

- Credit Damage: Foreclosure stays on your credit report for years.

- Emotional Stress: The process can be mentally and emotionally draining.

- Community Impact: High foreclosure rates can depress property values and destabilize neighborhoods.

For further details on how foreclosure works, check resources from the U.S. Department of Housing and Urban Development (HUD).

📜 New Foreclosure Defense Laws in 2024

Legislatures nationwide have recognized the urgent need to protect homeowners facing foreclosure. In 2024, several new laws and amendments have been enacted to bolster foreclosure defenses and ensure fair treatment for borrowers.

⚖️ Key Legislative Changes

Recent legal updates include:

- Extended Pre-Foreclosure Periods: Homeowners are now given additional time to negotiate with lenders or refinance their loans.

- Mandatory Mediation Sessions: Before foreclosure proceedings can continue, lenders must offer a mediation process to help borrowers find alternatives.

- Stricter Documentation Requirements: Lenders must provide clear evidence of default and prove that they followed all required legal procedures.

- Enhanced Consumer Protections: New laws have increased transparency around fees and loan modifications, reducing the risk of predatory lending.

These legislative changes are designed to give homeowners a fair chance to resolve their financial difficulties without losing their homes.

🛡️ What These Laws Mean for You

- More Time to Act: Extended deadlines allow you to explore alternatives such as refinancing or loan modification.

- Improved Access to Mediation: Mediation services provide a structured environment to negotiate with your lender.

- Stronger Legal Grounds: With better documentation standards, you can challenge foreclosure actions that don’t comply with the law.

- Enhanced Consumer Rights: Greater transparency means you can hold lenders accountable for hidden fees or deceptive practices.

For more detailed legal insights, visit the Consumer Financial Protection Bureau (CFPB) which provides up-to-date information on consumer rights.

🚀 Effective Tactics to Fight Foreclosure

Taking a proactive approach is essential when facing foreclosure. Here are several key tactics that can help you defend your home under the new laws:

1. Review Your Mortgage Documents Thoroughly

- Know Your Rights: Understand the terms of your mortgage, including any clauses related to default and foreclosure.

- Identify Irregularities: Look for errors or discrepancies in your loan documents that could indicate improper practices.

- Consult a Legal Expert: An attorney specializing in foreclosure defense can help interpret complex contract language.

2. Explore Loan Modification Options

- Refinance Your Loan: Investigate whether refinancing is a viable option to lower your monthly payments.

- Apply for Loan Modification: Work with your lender to modify the terms of your loan, such as extending the repayment period or reducing the interest rate.

- Document Everything: Keep records of all communications with your lender to support your case.

3. Utilize Mediation Services

- Participate Actively: Attend all mediation sessions and be prepared with a clear financial overview.

- Negotiate Effectively: Use mediation to negotiate a feasible repayment plan or a temporary forbearance.

- Seek Professional Support: Mediation experts or housing counselors can provide valuable advice during these sessions.

4. Challenge Unfair Foreclosure Practices

- Demand Proof: Request detailed documentation from your lender to validate their claims of default.

- File a Complaint: If you suspect illegal practices, file a complaint with your state’s attorney general or a consumer protection agency.

- Consider Litigation: In cases of egregious misconduct, legal action may be necessary to stop the foreclosure process.

5. Seek Government Assistance Programs

- HUD Home Affordable Modification Program: Explore government programs aimed at assisting homeowners in distress.

- Local Nonprofit Organizations: Many nonprofits offer free counseling and legal assistance to homeowners facing foreclosure.

- Community Resources: Check with local housing authorities for additional support options.

📝 Step-by-Step Action Plan for Homeowners

When foreclosure looms, a clear action plan can help you navigate the process and utilize available defenses. Follow these steps to protect your home:

Step 1: Assess Your Financial Situation

- Review Your Budget: Take a detailed look at your income, expenses, and outstanding debts.

- Gather Financial Documents: Collect pay stubs, bank statements, and tax returns.

- Consult a Financial Advisor: A professional can help you understand your options and develop a feasible plan.

Step 2: Review Your Mortgage and Loan Documents

- Identify Key Terms: Understand the specific conditions under which your loan may go into default.

- Look for Errors: Check for any discrepancies or unfair terms that could be challenged.

- Seek Legal Counsel: Contact a foreclosure defense attorney to review your documents.

Step 3: Contact Your Lender Immediately

- Initiate Communication: Reach out to your lender to discuss your situation before they proceed with foreclosure.

- Request Mediation: Ask about mediation options provided under the new laws.

- Document the Conversation: Keep written records of all interactions with your lender.

Step 4: Explore Alternative Solutions

- Loan Modification: Apply for a modification to adjust the terms of your mortgage.

- Refinancing: Consider refinancing options to lower your monthly payments.

- Forbearance Programs: Inquire if a temporary suspension of payments is available.

Step 5: File a Formal Complaint if Necessary

- Identify Unfair Practices: If your lender is not following legal procedures, file a complaint with relevant state agencies.

- Use Official Channels: Contact your state attorney general’s office or a consumer protection agency.

- Consult an Attorney: A legal professional can guide you through the complaint process and advise on further action.

Step 6: Prepare for Mediation or Legal Action

- Compile Evidence: Gather all documents, correspondence, and records that support your defense.

- Hire an Expert: Work with a foreclosure defense attorney who understands the new laws.

- Plan for Litigation: If mediation fails, be ready to escalate the matter legally.

“A proactive, well-documented approach is essential. Homeowners must act quickly to leverage the protections afforded by the new laws and defend their homes.”

– Foreclosure Defense Attorney

📊 Real-Life Case Studies and Success Stories

Learning from others who have successfully navigated foreclosure defense can be incredibly empowering. Below are some case studies that illustrate how homeowners have used these new laws to save their homes.

Case Study 1: Extended Pre-Foreclosure Timeframes

Sarah’s Story:

Sarah received a foreclosure notice but was granted an extended pre-foreclosure period due to new state laws. During this time, she successfully negotiated a loan modification and avoided foreclosure altogether. Her persistence and timely legal counsel allowed her to restructure her mortgage, keeping her home and restoring her financial stability.

“The extra time granted by the new laws was a game-changer. It gave me the breathing room I needed to work with my lender and avoid losing my home.”

– Sarah, Homeowner

Case Study 2: Effective Mediation Saves the Day

Mark’s Experience:

Mark found himself in deep financial trouble when he fell behind on his mortgage payments. When foreclosure proceedings began, he immediately requested a mediation session under the new mandatory mediation requirements. With the help of a housing counselor, Mark negotiated a temporary forbearance and a revised repayment plan that suited his financial situation, ultimately keeping his home.

“Mediation was my lifeline. The process was fair and helped me reach an agreement with my lender without going to court.”

– Mark, Resilient Homeowner

Case Study 3: Challenging Unlawful Foreclosure Practices

Linda’s Battle:

Linda noticed that her lender had not followed proper procedures before initiating foreclosure. With the help of a dedicated foreclosure defense attorney, she challenged the validity of the lender’s documentation. The court ruled in her favor, and Linda was awarded a full reset of her mortgage terms, allowing her to catch up on missed payments and avoid foreclosure.

“When I realized something was amiss, I didn’t hesitate to fight back. The new laws provided me with the leverage I needed to challenge my lender and keep my home.”

– Linda, Victorious Homeowner

🤝 Expert Advice and Consumer Protection Resources

When facing foreclosure, expert guidance can make all the difference. Below are several trusted resources and organizations that can help you navigate this complex process:

Legal and Counseling Resources

- Foreclosure Defense Attorneys: Specialized legal experts can assess your case and provide tailored advice.

- Housing Counseling Agencies: Accredited agencies offer free or low-cost counseling to help you manage your mortgage and explore modification options.

- State Consumer Protection Offices: Contact your state attorney general’s office for assistance with unfair lending practices.

Trusted External Resources

- HUD: Provides comprehensive information on foreclosure prevention and homeowner assistance programs.

- CFPB: Offers guidance on mortgage issues, including foreclosure defense strategies.

- Nolo’s Foreclosure Defense Guide: A detailed resource covering legal rights and strategies for homeowners.

Expert Tips for Foreclosure Defense

- Document Everything: Keeping meticulous records is your best defense against unfair foreclosure practices.

- Act Quickly: Time is of the essence when you receive a foreclosure notice.

- Leverage Mediation: Use the new mediation requirements to negotiate a better outcome with your lender.

- Stay Informed: Keep up with the latest legal changes and consumer rights updates to ensure you’re always prepared.

📋 Actionable Checklist for Homeowners

Use this checklist as a quick reference guide to ensure you’re taking all the necessary steps to defend your home:

- Review Financial Documents:

- Gather all mortgage documents, payment records, and correspondence.

- Verify the accuracy of all details and identify any discrepancies.

- Contact Your Lender:

- Initiate communication as soon as you receive a foreclosure notice.

- Request mediation and discuss modification options.

- Consult Experts:

- Meet with a foreclosure defense attorney.

- Seek advice from housing counseling agencies.

- Document Every Step:

- Maintain detailed logs, photos, and copies of all communications.

- Record dates, times, and specific details of every interaction.

- File Complaints if Needed:

- Contact your state consumer protection office.

- File a formal complaint if you suspect unlawful foreclosure practices.

- Prepare for Mediation or Litigation:

- Compile all evidence and prepare your case with your attorney.

- Follow through with mediation sessions or legal proceedings.

🔚 Take Control of Your Home’s Future

Foreclosure is a daunting process, but with the new laws enacted in 2024, homeowners have stronger defenses and more resources than ever before. By understanding your rights, documenting every detail, and taking swift action, you can navigate foreclosure proceedings and potentially save your home. Remember, knowledge is power—and in today’s legal landscape, every homeowner deserves a fair chance to protect their investment.

“Foreclosure defense isn’t just about saving a house; it’s about preserving hope, stability, and the promise of a secure future.”

– Housing Policy Analyst

Your home is more than just a building—it’s your sanctuary. Stay informed, seek expert advice, and take proactive steps to secure your financial future. If you’re facing foreclosure, don’t wait. Act now to explore every defense tactic available under the new laws.

💬 Call to Action: Share Your Story

Have you experienced the stress of foreclosure, or have you successfully defended your home under the new 2024 laws? Share your experience in the comments below to help others learn from your journey. Your story could inspire someone to take the necessary steps to save their home. If you have questions or need additional guidance, feel free to reach out—together, we can build a community of informed, empowered homeowners.

Read also:

- Car Lemon Law 2024

- Student Loan Forgiveness Scams

- Airbnb Legal Nightmares

- Renters’ Rights in Florida

📌 Additional Resources and Final Reminders

For ongoing updates and more detailed information on foreclosure defense tactics and new homeowner protections in 2024, bookmark these essential resources:

- HUD Foreclosure Prevention: Information on foreclosure prevention programs and homeowner assistance.

- CFPB Mortgage Assistance: Guidance and support for homeowners facing financial hardship.

- Nolo’s Foreclosure Defense Guide: Legal information and practical advice for navigating foreclosure.

- USA.gov Homeowner Resources: A portal to various federal resources and consumer rights information.

- Local Housing Counseling Agencies: Contact your local agencies for personalized, face-to-face advice and assistance.

Stay proactive and informed—these tools and resources are your allies in defending your home and securing your financial future.

This article is intended to provide comprehensive guidance on foreclosure defense tactics under the new 2024 laws. It is not a substitute for professional legal or financial advice. Always consult with qualified professionals regarding your specific situation.

Share your thoughts, ask questions, and let’s work together to ensure every homeowner has the tools they need to fight foreclosure and protect their future.